Whether Life Insurance Policy Generates Immediate Cash Value? -M Sathish Kumar's Analysis.

M Sathish Kumar's Analysis.

Whether Life Insurance Policy Generates Immediate Cash Value? -M Sathish Kumar's Analysis.

If you are searching for the right life insurance policy to generated cash value quickly or even immediately,

you will have a couple of different options. But you should be aware that more important than the type of policy—whole life insurance or

universal life insurance are going to be the two types—you need to know that policy design and funding will have the greatest impact.

M Sathish Kumar is a leading Insurance Activist from Coimbatore having profound knowledege in Insurance.His domain includes Life Insurance from LIC of India,

Health Insurance from Star Health and Allied Insurance company and Motor Insurance from United India Insurance.

He syas You can purchase the right type of policy and not achieve the desired outcome of growing cash value immediately.

The details very much matter when setting up your life insurance policy for the purpose of rapidly building cash value.

Working with s competent, reputable, and experienced life insurance Agent ensures

that you get are purchasing a policy that generates the cash value with the quickness you desire.

Which Types Of Life Insurance Have Cash Value?

There are two broad categories of life insurance that have the ability to produce cash value.

Those are whole life insurance and indexed universal life insurance.

Of course, there are quite a few iterations of both types of life insurance but broadly speaking those are the two that we use most often for our clients.

Particularly for those people looking to accumulate immediate cash value.

For whole life insurance, the most expensive component is what most life insurance companies call the ‘base death benefit’ or ‘base policy premium’.

That is the cost of the permanent death benefit that you are buying before you blend in term insurance and the premium going to the paid-up additions rider.

Mind you, all components are important and you must use the term rider and paid-up additions rider to have any chance of accumulating immediate cash value

in your whole life policy. Expense structure is what drives the bus here and why it is important to minimize the base policy costs as much as possible.

For indexed universal life insurance, finding the correct policy design is way easier.

You can easily design your IUL policy in reverse.

That is to decide how much premium you would like to pay and then minimize the death benefit to the lowest possible point

without creating a modified endowment contract (MEC).

This technique for designing an index universal life policy is referred to as a ‘minimum non-MEC’ design.

You are forcing the policy to accept as much premium as possible for a particular death benefit. Obviously,

the insurance company doesn’t need all of that premium to insure the death benefit,

so a sizable piece of the premium paid is credited to your cash value and earns index credits based on the underlying index you choose to follow in your policy.

Most have several indices to choose from.

How Long Does It Take To Get Cash Value From Life Insurance?

That is a very good question and gets right the heart of the matter with any type of cash value life insurance. Most people want to know how long it’s going to take for them to have cash value available in their policy.

Often that is because they are looking to borrow against the cash value in the form of a policy loan. But obviously, if there is little to no cash value, you are not able to borrow against it.

There is no way to give a definitive answer to the question of how long it takes to get cash value from your life insurance policy. However, the best answer is that it will depend on how much premium you are paying, how old you are, and what health rating class were you given when the policy was issued.

Think about this logically for a moment. If you wanted to have Rs 10 LAc k available in cash value to get from your policy six years from now, you would need to pay more than Rs 2 Lac each year in premiums. Life insurance policies offer a nice, decent, stable return over time but it is not a miracle producer of huge returns in the short term. If you have a short time horizon, your policy design and premium funding amount are of the utmost importance.

You can contact Mr Satish Kumar at 9443385797/8508585000

Glimpse from M Sathish Kumar's Honuors and Recognition.

M Sathish Kumar recrieving CORPORATE TROPHY

M Sathish Kumar recrieving REPUBLIC DAY HONOUR

M Sathish Kumar recrieved ONE DAY MILLIONAIRE CERTIFICATE 2017

M Sathish Kumar wins CORPORATE TROPHY WINNER OF 2016

M Sathish Kumar RECEIVED THE MOMENTO FROM OUR SENIOR DIVISIONAL MANAGER ,FOR THE

M Sathish Kumar BUSINESS PERFORMANCE IN JUNE 2018

ACHIEVED MILLION DOLAR ROUND TABLE (MDRT ) USA 2019

DA CLUB AGENT AWARD

WITH MDRT TROPHIES IN HOTEL LE MERIDIAN COIMBATORE IN JANUARY 2019

RECEIVED SUPER STAR ACHIEVER AWARD FROM OUR SENIOR DIVISIONAL MANAGER ON 09.03.2018

MY FAMILY IS HONORED BY OUR ZONAL MANAGER AND SENIOR DIVISIONAL MANAGER FOR MDRT 2019

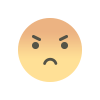

RECEVING MDRT 2021 TROPHY MDRT TROPHY

TRAINING SESSION WITH LEGEND MR.GOPINATH SIR

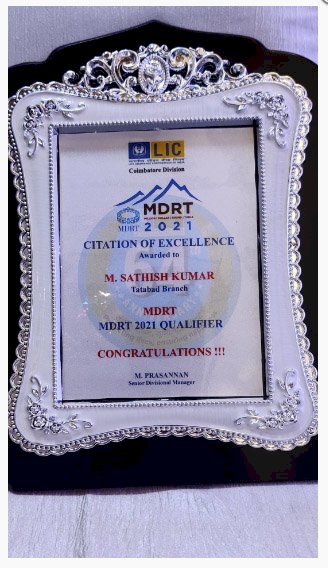

HALF CENTURION TROPHY DURING YEAR 2019-2020

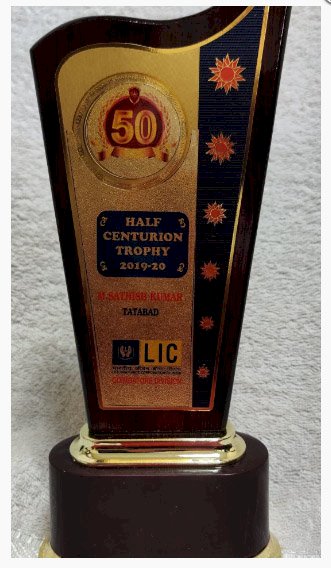

QUALIFIED FOR TRAINING SESSION IN INDIAS LEADING INSTITUTE MDI GURGOAN

BUSINESS PERFORMANCE AWARD FROM OUR CHIEF MANAGER MR.RAJAGOPAL SIR & ABMS MS. SREEDEVI MADAM.

TRAINING SESSON IN MANAGEMENT DEVELOPMENT INSTITUTE GURGOAN ,DELHI

ENJOYING THE SERVICE OF 15 YEARS

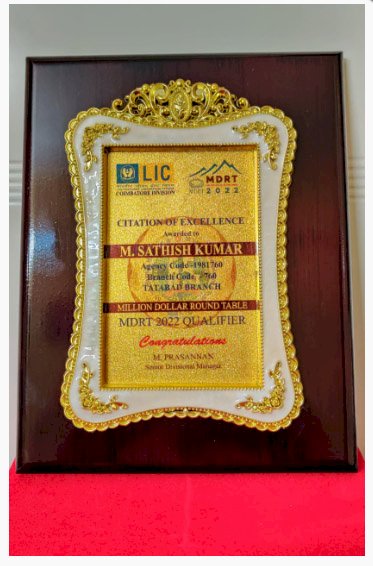

MDRT -2022- AWARD

EXCELLENCE AWARD FROM RANJAN NAGARKATTE SUCCESS ACADEMY

3 RD MDRT AWARD FROM TEAM MURALI

HATRICK -5 LAKHS POLICY GIVEN CONTINOUS 3 DAYS

HALF CENTURION & NDEPENDENCE DAY HONOURS -2021

BM,ABM& OUR SBA VISITED MY RESIDENCE AND HONOURED FOR THE PERFORMANCE OF 2021

What's Your Reaction?